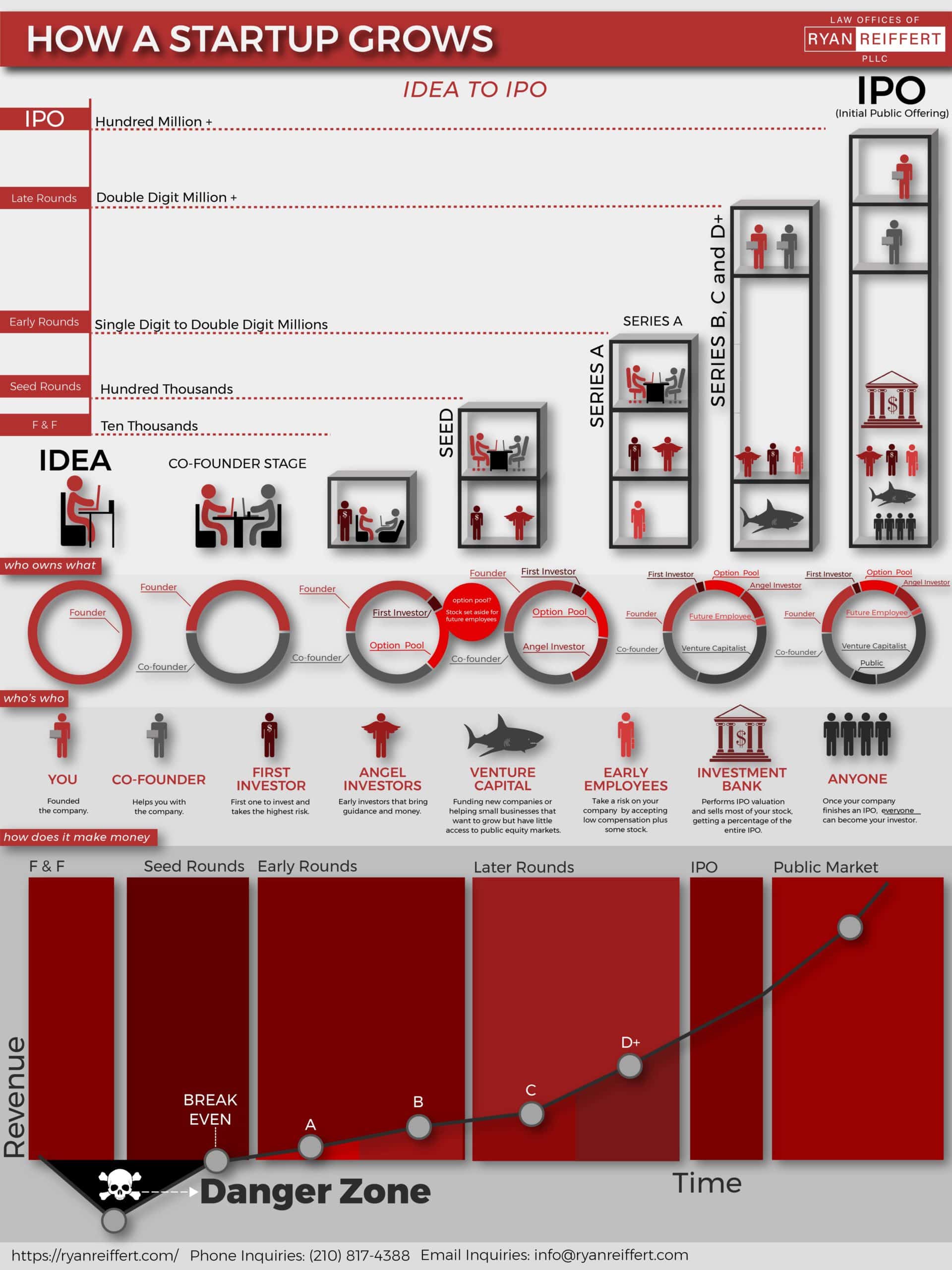

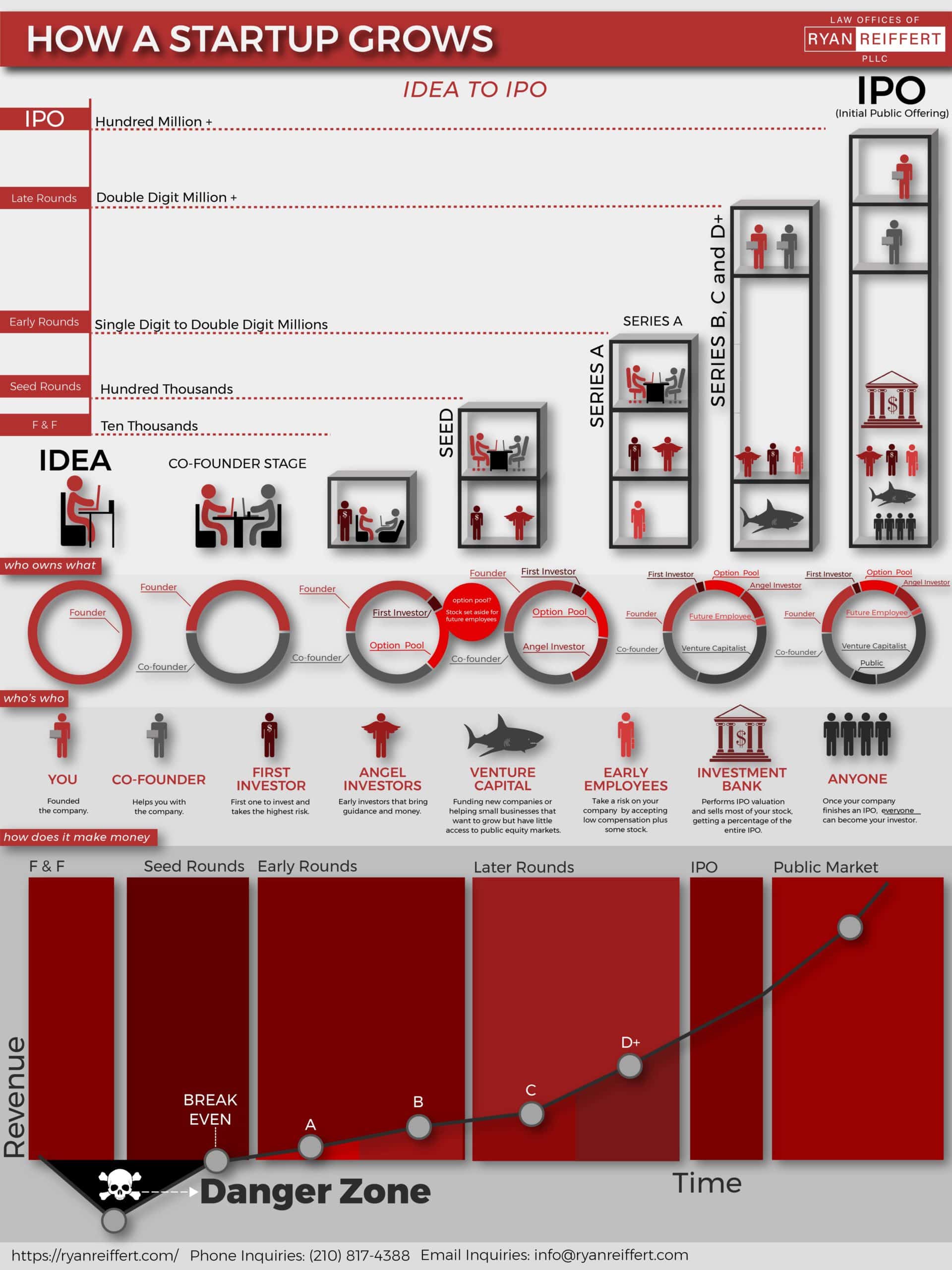

INFOGRAPHIC: How a Startup Grows

Share

The attached infographic shows an example of a company’s journey from its beginning to initial public offering (IPO).

Your startup may or may not follow this exact path – some stages may be compressed into one, and others may be separated into different parts. Your company may receive a buyout offer somewhere along the way. You may have more than just one cofounder, or you may have zero. You might not take venture capital. You might linger at the angel investor stage a bit longer. An IPO may not be your exit plan at all (i.e., you may plan to stay private for as long as possible).

Along your journey, you will need to comply with and become aware of securities laws (for example, accredited investor rules or increases to certain exemption caps or other developments)

Certain other features will almost always be present (although in perhaps different forms) – the danger zone before becoming revenue negative, the need for mentors and connectors (frequently angel investors), and more.

Regardless of what your journey will entail, you will need competent business advisors (corporate attorney, accountant, banker, and more) to help you navigate this path. You can visit our startup practice for more information.

And above all, remember: EVERY BIG BUSINESS STARTED OFF AS A SMALL BUSINESS

Contact Us

The attorney responsible for this site for compliance purposes is Ryan G. Reiffert.

Unless otherwise indicated, lawyers listed on this website are not certified by the Texas Board of Legal Specialization.

Copyright © Law Offices of Ryan Reiffert, PLLC. All Rights Reserved.