Estate Planning in San Marcos, TX

Many people spend their entire lives working to provide for their loved ones. An estate plan is one way to ensure that financial protection continues.

Contact ushigh-level practice

educational background

In-House perspective

Under Texas law, the State of Texas will determine the disposition of your assets should you happen to die without a will or trust. If this doesn’t sit well with you, there’s no time like the present to give my office a call. In the interest of your peace of mind, the security of your loved ones and the preservation of your legacy, estate planning is essential.

Get in touch

How I Can Help

I represent individuals throughout San Marcos in a range of estate planning and probate matters, including:

- Drafting trusts and wills (including holographic wills)

- Preparing medical directives

- Creating powers of attorney

- Assisting with business succession planning

- Probate and estate administration (including lower-cost and simplified probate procedures, such as the transfer of real estate by probating a will as a muniment of title or using an affidavit of heirship; or the transfer of real estate and other property by way of the small estate affidavit.

All About Estate Planning in Texas

Many people spend their entire lives working to provide for their loved ones. An estate plan is one way to ensure that financial protection continues.

For those who have built a business and may want to hand it down one day, the business succession plan can be the key to preserving that legacy. Many people also have wishes about what should happen to them if they are under medical treatment and unable to speak for themselves. An end of life plan can include various other documents that will ensure your decisions are respected. Many younger parents also want to do everything in their power to ensure their children are taken care of — no matter what happens to them.

Creating an estate plan can allow you to protect your loved ones, secure a legacy, further a cause, preserve the family business, or any number of other things. I can help you create an estate plan that is right for you, and your wishes. If you would like to learn more, you can Contact Me or, if you’re curious about other services, please feel free to read about Other Practice Areas.

Estate Planning Misconceptions

In the practical sense, estate planning is an end-of life issue, even if one starts their estate planning early in life. Consequently, many people procrastinate and forestall addressing estate planning because—let’s face it—no one really wants to contemplate their mortality that deeply.

As indicated above, some people don’t think they own enough to justify an estate plan; others aren’t sure where to start or where to seek help. Some people think they can’t afford it. Still others believe they’ll have plenty of time to do it “later”—which can lead to extremely troublesome outcomes for their loved ones in the event that something unexpected occurs. You might be surprised to learn that there are many people of substantial wealth and even fame—Aretha Franklin and Prince among them—who died intestate (without a legal will). By not preparing estate plans, people make the task of settling their affairs a potential nightmare for their survivors.

If you die without an estate plan, any assets owned in your name and without beneficiary designations or governing contracts will be distributed according to State of Texas intestacy laws through a court-supervised probate proceeding. Everything you’ve worked to build—regardless of value—will be at the mercy of these laws, with your wishes and the well-being of your survivors receiving minimal consideration.

Wouldn’t you prefer that these matters were handled ahead of time, privately and according to your wishes, rather than by the courts?

While many people think more about it as they get older, estate planning isn’t just for people in midlife or those approaching retirement. Nor is estate planning just for the wealthy, although those with a lot of assets do tend to think more about it. The fact is that in the relative sense, solid estate planning can benefit those with modest assets even more than those who are wealthy.

Just What is Estate Planning?

Estate planning is the execution of certain proscribed or legally required tasks that address the disposition of an individual’s assets in the event of their incapacitation or death. This includes the bequest of assets to heirs or designated organizations the settlement of estate taxes. It necessarily involves advance planning to make the requisite designations (e.g., who you’d like to receive your assets) and taking steps to ensure that the plan is carried out smoothly and in accordance with your wishes.

Good estate planning should also include:

- Life insurance to provide for your family at your death

- Instructions for your care and finances affairs should you become incapacitated prior to death

- Disability income insurance to replace your income if you cannot work due to an illness or injury

- Provisions for the disposition of your business and/or business interests at your retirement, disability, incapacity or death

- Guardianship arrangements for minor children, their care and inheritance

- Long-term care insurance (in the case of an extended illness or injury)

- Provisions for loved ones with untoward financial liability or entanglements (creditors, divorce)

And while the lion’s share of the work you and your attorney perform on your estate plan will be done at the beginning, bear in mind that estate planning is an ongoing process rather than a one-time affair. As assets, laws, financial circumstances and your wishes evolve, you may find it necessary to adjust the sails from time to time to reflect those changes.

Estate Planning Basics

In general, there are five major attorney-prepared documents that constitute a “basic” estate plan. These include:

- Will

- Medical Power of Attorney

- Durable Power of Attorney

- Physician Directive

- HIPAA Authorization

To these, you will add certain non-legal (but very important) components such as beneficiary designations and insurance (see below), and you’ll have crafted a very solid basic estate plan. There are ancillary components that you may choose to add depending on your wishes and the complexity of your estate. These may include trusts, Lady Bird deeds, Life Estate deeds, business succession plans, etc. These and other options can be explained in detail by your attorney.

Regardless of the complexity of your estate, your age, health and other factors however, it is always prudent to engage the services of an estate planning attorney to help you navigate these waters.

Pre-Planning

While you’ll get into the particulars of crafting your estate plan with your attorney, there are some aspects that you can address in order to enhance your understanding and streamline the process. Some things you can do even before you sit down with a lawyer include:

Itemizing physical assets – Your home(s) and possessions therein and on your property, collectibles, vehicles, and sundries. In short, anything you own that’s of intrinsic material value should be listed.

Itemizing non-physical assets – These would include non-tangible assets such as 401(k) plans, IRAs, bank accounts, brokerage accounts, life insurance policies, and long-term care, homeowners, auto, disability and health insurance policies.

Compiling a list of debts – This is pretty straightforward. Here, you’ll simply make a list of credit cards, credit accounts and other obligations. This will include auto loans, mortgages, home equity lines of credit (HELOCs), and any other debts, along with the account numbers and creditors holding the debts.

Reviewing retirement and insurance accounts – By law, accounts and policies that have designated beneficiaries will go directly to those people or entities upon your death. Keeping these current is especially important if you have divorced and remarried. Even though beneficiary designations take legal precedence, they’ll still play a part in your estate planning, so your attorney will need that information.

Assigning POD & TOD designations – When you name a beneficiary on a bank account, the term that is typically used is Payable on Death, or POD. When naming a beneficiary of a brokerage or investment account, the designation is usually Transfer on Death, or TOD.

Many people are unaware of this, but assets bequeathed in wills often go through the probate process. However assets such as bank savings, CD accounts, and individual brokerage accounts can be amended to include these designations, allowing beneficiaries to receive assets without going through the probate process.

Considering your estate administrator – This is another item you’ll be discussing at length with your attorney, but it is wise to give consideration to this well ahead of time. Your estate administrator (executor or executrix) will be in charge of executing your will. Many people presume that a close relative is a sound choice, but this isn’t always the case given the attendant emotional considerations that can arise. The person you choose should not only be trustworthy, but responsible and of sound mental capacity.

Reviewing memberships – If you belong to any trade, professional organizations or alumni groups, now would be a good idea to review the terms of your memberships and make a list of them. Many of these organizations carry accidental death or other life insurance benefits as part of their memberships, and your beneficiaries could be eligible to collect upon your death.

Determining Your Objectives

While determining your estate planning objectives is something you will undoubtedly cover with your attorney, this is another aspect that you should give some thought to ahead of time if you haven’t already done so. Your objectives will drive the estate planning process, and objectives are as varied as those seeking estate planning. In the simplest terms, your objectives are a general or detailed idea of what you want to do with your assets. If you have minor children, your objectives are likely to be different than if your children are grown. Do you have children from a previous marriage whom you’d like to provide for? Do you have grandchildren, and what would you like them to receive? What would you like to see happen if both you and your spouse become incapacitated or die simultaneously? Are there charitable organizations, schools or universities to which you’d like to bequeath a portion of your assets?

These are just a few of the myriad concerns that shape the objectives of those seeking estate planning.

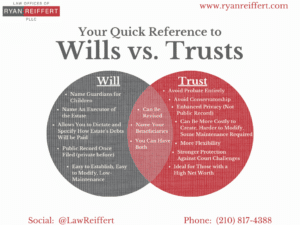

Wills vs. Trusts

Among the key components of any estate plan is the will or trust—and if you’re a bit fuzzy on the distinction between wills and trusts, you’re certainly not alone. While there can be some overlap between wills and trusts, and both are vehicles by which you determine who will receive your assets, there are also important differences between the two.

Key provisions of wills:

- Effective upon your death

- Designates disposition of assets

- Names guardians for minor children

- Specifies your final arrangements

- Limited control over the distribution of assets (as compared to trusts)

- Generally, a simpler document (as compared to trusts)

Key provisions of trusts:

- Effective immediately upon signing

- Requires funding upon signing

- Covers any assets held within the Trust

- Many different forms and types

- Offers greater control over the distribution of assets (as compared to wills)

- Generally, a more complicated document (as compared to wills)

While the goals of those seeking estate planning differ from person to person, fundamentally, they all want a certain degree of clarity with the process, and they want their wishes to be respected. I strive to provide these for each and every one of my clients. I will also help you to understand all aspects of the process, including probate, powers of attorney, guardianships, Special Needs Planning, estate taxes, trust administration or any other component that is relevant to your wishes and objectives.

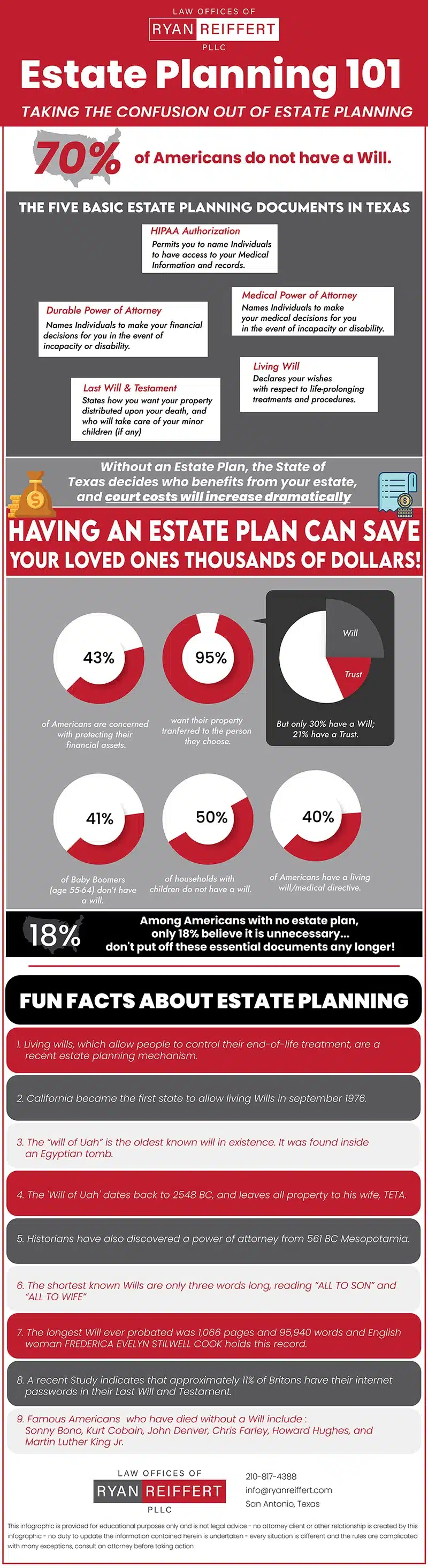

US Estate Planning Facts and Statistics

– Click to enlarge the infographic below (Opens in a new tab) –

Whether your estate plan is about your own dignity at the end of life, preserving your legacy after death, furthering a treasured philanthropic or charitable cause, caring for your loved ones, ensuring the survival of the family business, and/or any other goal you would like to include in your plan, you may have to overcome some legal obstacles and nonlegal dynamics to get from Point A to Point B.

That’s where I come in. I’ll help you navigate the forest of jargon, documents and the complicated web of family relationships, doing everything I can to make that process easier, simpler, and far less intimidating.

Reasons to work with us

Why Choose Ryan As Your Business Attorney

Excellent Track Record

If you are a startup navigating legal waters for the first time or a small business… If you are an established business looking for a high-quality corporate lawyer… If you are an individual seeking to protect yourself…

If this is “not your first rodeo” and you don’t need hand-holding, you just need a seasoned deal-closer… If your family business is looking for guidance on how to expand or break new ground…

Fee Transparency

Legal work can be expensive, and nobody likes a surprise bill. Having been in-house General Counsel, I have been in that boat, too. I can’t cover all your legal needs for free, but I can help you think about which expenses make sense and which expenses don’t… before we start the clock.

Unlike some of the larger and older law firms, I can also help with some unique and tailored alternative fee arrangements.

Personal Attention

My philosophy is simple. I believe that when you hire an attorney, that attorney should handle your issue.

Therefore, when you hire me, I will handle your issue. When you call my office, you will talk to me (unless I am meeting with another client). When you have questions, I will be the one answering them (if I can).