Why You Need Skilled Asset Protection Lawyer in San Antonio

Any time you own substantial assets, a successful business enterprise, or work as a professional in a litigious environment, you can become a target for lawsuits or creditors. There are many asset protection strategies that we can offer, including LLC asset protection, Corporation asset protection, Limited Partnership asset protection, and more. Whether you own assets personally or your business owns them, your hard-earned assets can be taken in a judgment if they aren’t adequately protected. While there are some strategies that you can undertake to achieve asset protection after a lawsuit is filed, it is (not surprisingly) much easier to structure your affairs before any lawsuit or judgment. Accordingly, it is highly important to make an asset protection plan before a lawsuit, not after a lawsuit. You want to make sure you are prepared with a comprehensive asset protection plan that is geared toward you and your specific needs and goals. In order to properly prepare for this worst-case scenario, consulting with a competent Texas asset protection attorney is crucial. While there are no completely fail-safe guarantees that you won’t be targeted at some point in time, if your assets are properly structured, it will be more difficult for another party to attach to them. Minimizing any potential leverage another party may have over the things you have worked so hard for offers incredible peace of mind. With the aid of a skilled business lawyer, you can safely and legally protect your assets by restructuring them utilizing legal vehicles – such as using LLCs to protect assets. These will separate them from you or your company while still enabling you to have access and control of them.

Don’t Be Caught Off Guard

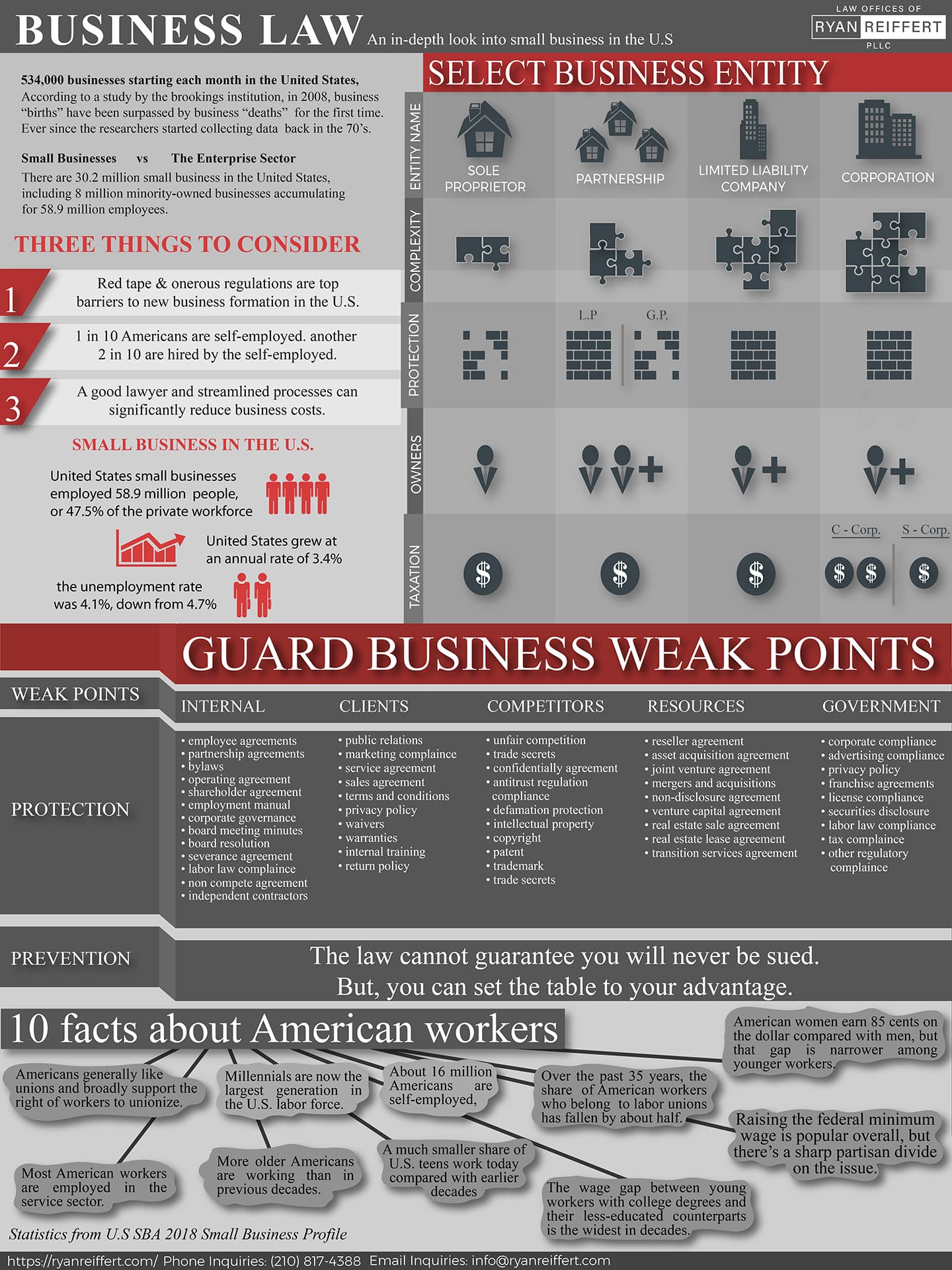

As an individual with substantial assets or as a business owner, you never want to be caught off guard. Asset protection should not be considered as a quick fix for a current legal issue. Consequently, putting together a comprehensive protection plan should always be proactive, not reactive. By the time you know about an impending lawsuit or creditor action, it will probably be too late to get a protection plan implemented. Moving assets after a lawsuit is filed will only open the door for accusations of fraud. In the state of Texas, we have many laws that already provide a significant amount of protection to individuals and offer a great number of opportunities for shielding assets and income. This makes the state particularly popular for asset protection, so even if a judgment against you is awarded, that party will not have access to some of your valuable assets. In addition to those afforded by the state, there are a wide variety of devices and strategies to protect business or personal assets by ● Creating legal barriers that protect you from personal liability ● Separating assets with separate legal entities ● Maintaining public record anonymity ● Using state income and homestead protections ● Using a series LLC to compartmentalize and safeguard multiple assets ● Equity stripping While every plan must take a tailored approach, some very methodical strategies and vehicles can keep your assets protected from lawsuits and creditors.Taxes, Death, Creditors, and Lawsuits

As they say, death and taxes are facts of life. But for many in the business world, so are creditors and lawsuits. While avoiding lawsuits and creditors will always be the goal, lawsuits and creditors are simply inevitable in some business or professional arenas. Many times, deep pockets are targeted in lawsuits and asset searches are routinely done to establish just that. This is when you want to ensure that you have made it as difficult and cost-prohibitive as possible for someone to get access to your assets. Especially if you are a successful business owner or investor and have accumulated significant assets, or if you work in a high-risk professional environment, you will want to consider more sophisticated asset protection vehicles.Separating Assets

Personal asset protection and business asset protection may use different vehicles, but protection is still the strategy. Business assets can be particularly vulnerable when the entity that operates the business owns the assets. Protecting business assets will start with separating the core business activities from the ownership of its assets. Fortunately, there are multiple methods and legal vehicles and strategies that can be used to protect business assets from lawsuits and creditors.Limited Liability Companies

Solid protection strategies will separate and insulate assets from the core business and from each other, so if a lawsuit attaches to one, it will be limited in its reach. Many times, this will including the use of multiple entities such as corporations, partnerships, and LLCs, in combination, to achieve the greatest degree of asset protection.Q: I created an LLC on the Texas Secretary of State’s website. Does the LLC protect my assets and solve all my problems?

A: Probably not. The good news is that you have made a good start with your LLC-based asset protection strategy, and you are somewhat better off than someone who does not use business entities or use an attorney-developed plan to shelter assets. The bad news is that there are likely still a number of “holes in your armor” and areas where you are open to attack by lawsuits or creditors. LLC asset protection is just the first piece of the puzzle. Using multiple entities with proper structuring, the correct connections between them, etc., designed and implemented before a lawsuit, will give you the most asset protection after a lawsuit.

Valuable assets should be separated from the core operation of a practice or a business. While one entity operates and manages the business, the assets are owned by other entities and can even be leased back to the core business. One method of doing this is through multiple limited liability companies. While the core business’s activity and management takes place through the main management LLC, it holds no real assets so, if litigated against, they aren’t lost in a suit. A series LLC or holding company will hold and compartmentalize assets to keep them insulated from each other and from lawsuits and creditors that target the core business. Even if a suit is filed against the main shell LLC, the holding company has not done business with anyone as a basis for any legal action against it. There are several ways to structure assets, and an experienced business lawyer can offer options such as ● Forming a shell management LLC ● Creating a holding company or series LLC for assets ● Ensuring anonymity when forming LLCs ● Forming an anonymous land trust ● Operating under DBAs ● Using your attorney as a registered agent Your lawyer will be able to direct you on how to best form and operate LLCs, using as much anonymity as possible to ensure the most significant asset protection for your enterprise. Asset protection trusts are vehicles that will hold assets independently from an individual. Trusts can avoid probate, allow for ease of transfer, and offer privacy. An individual can establish a trust as a grantor and also be a beneficiary of the trust with access to its assets. Although a trust does not offer the same level of liability barrier as an LLC, depending on your situation and goals, trusts can be a good tool to offer some level of protection for your assets while maintaining control of them. These can include: ● Domestic asset protection trusts ● Spousal lifetime access trusts ● Special power of appointment trusts ● Irrevocable life insurance trusts ● Irrevocable gifting trusts ● Qualified personal residence trusts As a general rule, only individuals, not corporations or LLCs, may take advantage of homestead protections. Your principal residence, or homestead, should always be considered in any asset protection strategy. Texas has one of the most advantageous homestead protections in the nation. Under state exemptions, the entire value of your homestead is protected from any forced sale to pay creditors or judgments instead of just a portion of it. No matter the value of your homestead property, no creditor or lawsuit can force its sale. There are, however, exceptions to this protection in the case of a mortgage or home equity liens, property taxes, federal taxes, or any other liens that may have pre-dated property exemption laws. Some types of income, limited personal property, and some retirement or prepaid tuition accounts are also exempt from creditors and lawsuits. A creditor cannot garnish wages, however once it becomes cash in a bank account, creditors can have access to it. Consequently, cash is extremely vulnerable. For someone who wants to protect cash from a creditor or lawsuit, it can carefully and slowly be converted into exempted assets or used to pay for legitimate things. But especially if a lawsuit is pending, this conversion may be challenged, and the individual must be able to defend any cash conversions as being money spent in the “ordinary course of business” that is justifiable and independent of the lawsuit. Other exempted assets exist under law. A creditor cannot collect money from some sources such as Social Security, VA benefits, or spousal or child support. Other exempted assets include ● College tuition savings plans and prepaid tuition ● Annuities ● Life insurance policies ● IRAs ● 401(k)s ● Traditional pension plans ● Profit-sharing plans Creditors have little interest in real property that has no equity. Borrowing against property reduces its available equity and makes it less attractive to creditors. By encumbering a property with a lien, such as a home equity line of credit, “stripping” it of its equity, it makes a property less attractive to creditors. Although there are some advantages to equity stripping, it’s important to understand that interest rates on these loans can be significantly higher than other mortgage vehicles and they will typically use the asset as collateral, so any issues can result in the loss of the home or property in foreclosure. Total asset protection is not entirely achievable, but everyone can benefit from some level of asset protection. Especially if you own substantial assets or a business entity that does, or if you are professionally employed in a high-risk or litigious industry, you will want to be as protected as possible against lawsuits or creditors. Getting the advice of a skilled business lawyer will enable you to understand what is best for your unique situation and afford you the most protection possible. If you have questions regarding Texas asset protection as it applies to you or your business, contact the Law Offices of Ryan Reiffert, PLLC, to schedule an appointment. If you’re still curious about other (legal) methods of hiding and protecting your assets, you can watch my YouTube video on this topic, here: