Business Succession Planning Attorney in San Marcos

Contact ushigh-level practice

educational background

In-House perspective

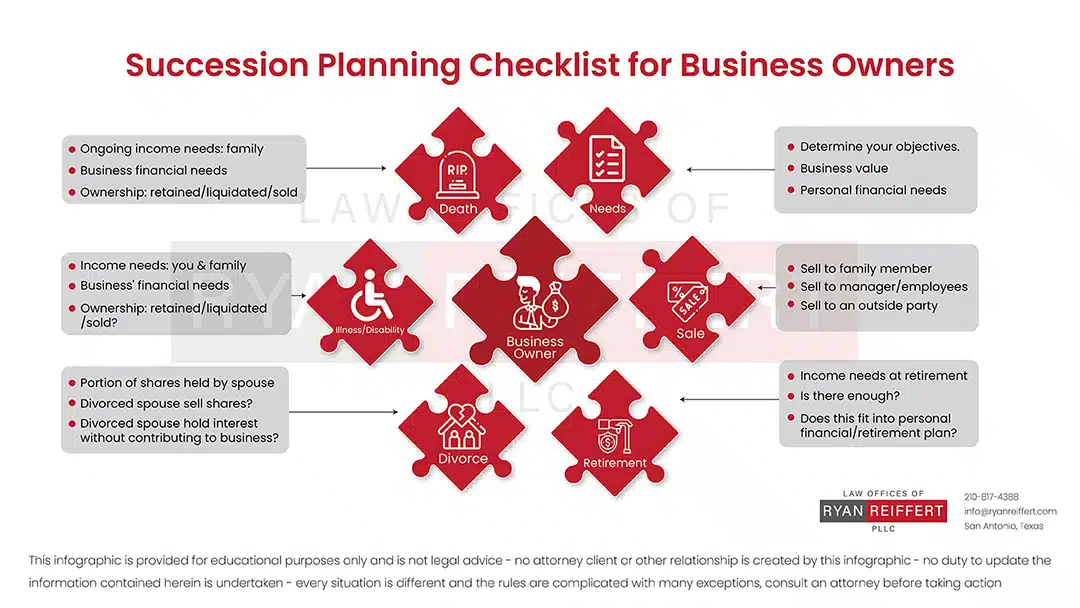

Ask Yourself These Important Questions: What will happen to your business if you unexpectedly die? How about if you divorce? What happens if your business partner dies or divorces? What happens if you become incapacitated? Although we all like to believe that we will run a successful business until we choose to retire, life often has other plans. Having a business succession plan is like a combination prenup and estate plan for your business. Although you may not think anyone can possibly run your business as successfully as you can, a business succession plan is critical to ensure that your business is properly handed down to the right person or otherwise transferred upon your retirement, death, or disability. Preparing your business for an eventual succession should be on every business owner’s radar to ensure that operations continue and there is no disruption in service.

Get in touch

Some of the biggest hurdles facing business owners as they think through a business succession plan include liquidity, valuation, and control. While many common approaches to this topic include the use of various types of trusts, there isn’t necessarily a one-size-fits all approach, and I can help you think through these issues (among others).

If you’d like to learn more about business succession plans, please contact me, or if you’re curious about other services, please read about Other Practice Areas.

All About Business Succession Planning

What Happens if You Don’t Have a Business Succession Plan in Place?

When a business owner doesn’t have a succession plan in place, and something unforeseen happens, ownership may just be passed on as part of an estate or absorbed by other owners or shareholders. In family businesses, this can create untold animosity and disputes. Whoever temporarily replaces you may not be up to the task. Employees may leave due to job insecurity. This can put the company on precarious ground and lead to a loss of reputation, employees, assets, or even result in the end of the business itself.

Successful business succession plans preemptively set out all the logistical and financial decisions that need to be made about who will take over the business and how they will do it. Although business succession plans are commonly used with retirement in mind, they also serve an essential function should the unexpected happen. Having a plan in place reduces the stress, headaches, and potential losses that can occur when an owner is suddenly unable to continue running the business.

The Advantages of Having a Business Succession Plan in Place

Having a business succession plan in place ensures a smooth transition and communicates the owner’s goals for the company’s future to everyone involved. A well-conceived succession plan offers a set of procedures that will guide the business through the transition, names a successor, and can help reassure employees. A business succession plan must consider many factors and can be tailored to any business, large or small.

How Do Businesses Get Transferred?

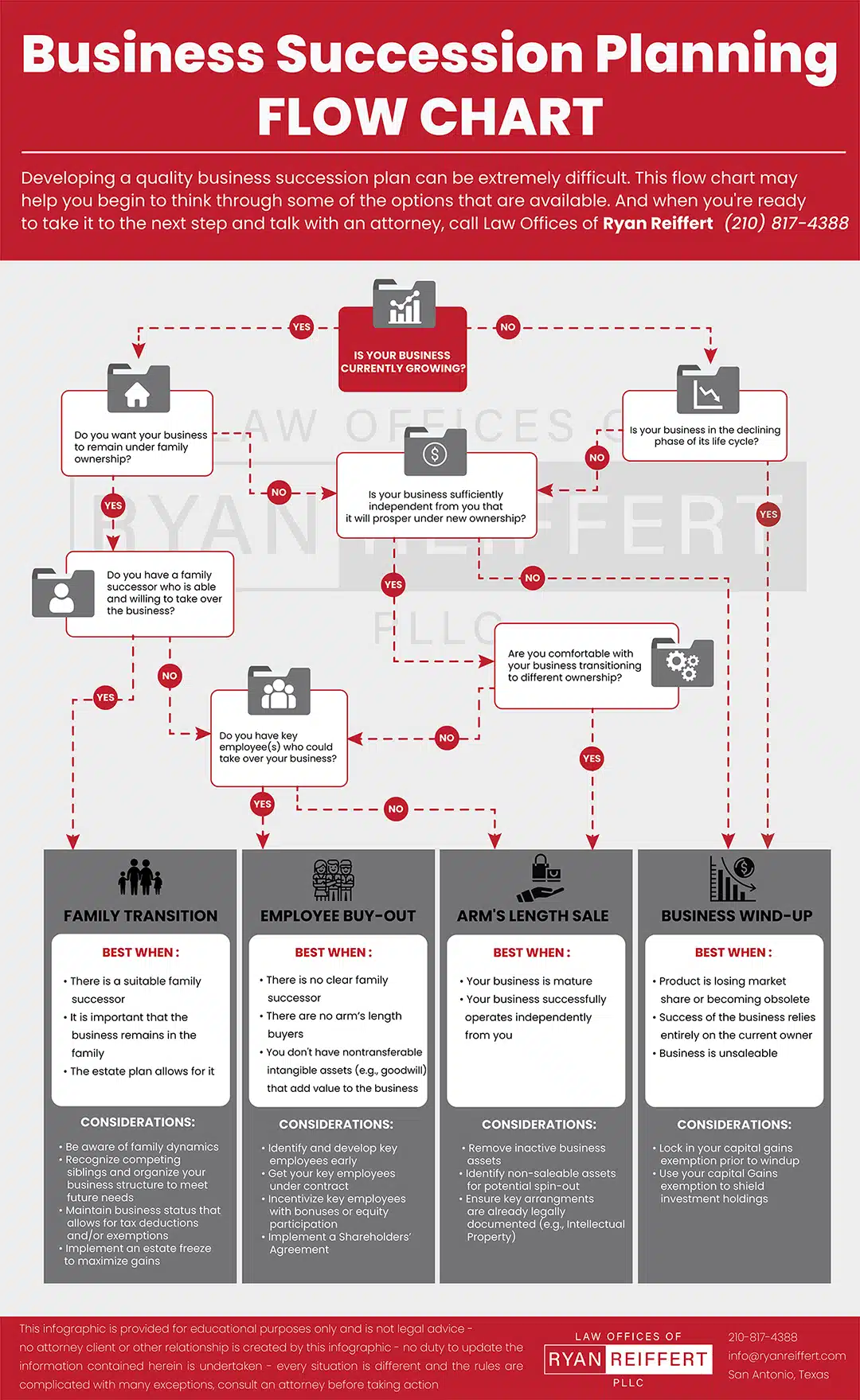

There is no one-size-fits-all approach to business succession. While some businesses are passed on to future generations, others look to sell to a competitor, or become purchased by select employees. The most common ways that business owners transfer ownership are

- Selling shares of the business to a co-owner

- Selling the business back to the company to be distributed to the remaining owners

- Passing the business down to family members

- Passing ownership down to key employees

- Selling to an outside entity

Depending on the wishes of the business owner/owners and the unique circumstances surrounding the business itself, there are multiple different paths to consider, each having benefits and challenges.

The Emergency Route

While the end game of a succession plan may be to set out what will happen when the current owner retires, it’s essential to have another plan in place that can be quickly implemented in the case of death or other emergency.

Although most business owners may prefer not to think about the unthinkable, having an emergency plan in place is crucial. Emergencies are never planned, and a business owner needs to consider important details should one happen. Who will take over the daily running of operations? What resources may be available to carry the business should it run into fiscal issues during the emergency? What message will be released to clients, customers, employees in order to reassure them that things are under control?

While an emergency is not as pleasant as thinking about that elusive retirement, focusing on the emergency brass-tacks plan first will force a business owner to focus on the nuts and bolts of running the business and who is best suited to take over. While thinking of hypothetical retirement and handing down your beloved business to your offspring may seem like a lovely fantasy, the reality may be that the child that you are considering in that fantasy is not the right person when you get down to planning for an emergency.

The Long-Range Plan

After the reality of the emergency plan has cleared away the fuzzy fiction, you have a clearer insight into the reality of who is best suited to take over the business and your long-range plans can become a bit more realistic. In some cases, understanding the plan from an emergency standpoint can completely alter your plans for the long-term.

Your long-term succession plans should involve transparent communication with everyone involved. Family members should know and understand their roles if the plan is for them to take over the business. The same is true if you are considering an employee or group of employees. Often, when employees have a stake in the company’s future, this serves to incentivize them to take a greater interest in the growth of the business. If your plan is to sell the business, it is always fair that employees know this as well.

Regardless of your succession plans for the business, once you have these formalized in your mind, you need to put the legal structures and processes into place to ensure that it works like it is meant to when the time comes.

Creating a Succession Plan

Although each business succession plan will look different, some key steps must be taken for any plan. These may require the assistance of professionals, especially for businesses with more complicated structures. Regardless, any succession plan should set out

- A timeline of when and under what circumstances a succession should take place, either by event or a predetermined date in the case of a retirement

- The successor should be named in addition to several other potential candidates with corresponding business profiles for each

- Standard operating procedures must be documented, an organizational chart developed, employee handbook or operations manual should be created, or anything else that adds information about processes and protocols within the company

- Valuing the business and keeping this information continually updated

- Defining the path of how a successor will take over or purchase the business and what options are available as far as funding

Other arrangements can be made to transfer ownership interests into trusts to benefit family members or divide assets among employees.

Creating a business succession plan can be legally complex, and most business owners rely on a professional business succession planning attorney in San Marcos to help develop the right strategy for their situation. This is particularly true when a business is the main asset that will be funding retirement, and the succession plan and estate plan must be interconnected.

Getting Professional Assistance

While most experts agree that business succession plans should be made three to five years before retirement, this doesn’t address an emergency. As a business owner, a business succession plan offers you incredible peace of mind knowing how your business will transfer and who will succeed you when the time comes. A succession plan created by a legal professional ensures that all legal processes and documents are correctly drafted and put into place.

Buy-Sell Agreements

One of the most common, and most important, business succession tools is the buy-sell agreement. The buy-sell agreement allows for you, the business owner, to make a plan for an unexpected event of death, divorce, etc. that both provides for continuity of the business, as well as provides for the family or loved ones of the surviving business partner(s). As a contract that binds the estate, a buy-sell agreement can be enforced before the shares pass to the heirs (or ex-spouse).

Contact Us Today!

At the Law Offices of Ryan Reiffert, PLLC, we are experienced San Marcos business succession planning attorneys who help business owners develop and implement the best strategies for their unique situation. Contact us to learn more.

Reasons to work with us

Why Choose Ryan As Your Business Attorney

Excellent Track Record

If you are a startup navigating legal waters for the first time or a small business… If you are an established business looking for a high-quality corporate lawyer… If you are an individual seeking to protect yourself…

If this is “not your first rodeo” and you don’t need hand-holding, you just need a seasoned deal-closer… If your family business is looking for guidance on how to expand or break new ground…

Fee Transparency

Legal work can be expensive, and nobody likes a surprise bill. Having been in-house General Counsel, I have been in that boat, too. I can’t cover all your legal needs for free, but I can help you think about which expenses make sense and which expenses don’t… before we start the clock.

Unlike some of the larger and older law firms, I can also help with some unique and tailored alternative fee arrangements.

Personal Attention

My philosophy is simple. I believe that when you hire an attorney, that attorney should handle your issue.

Therefore, when you hire me, I will handle your issue. When you call my office, you will talk to me (unless I am meeting with another client). When you have questions, I will be the one answering them (if I can).