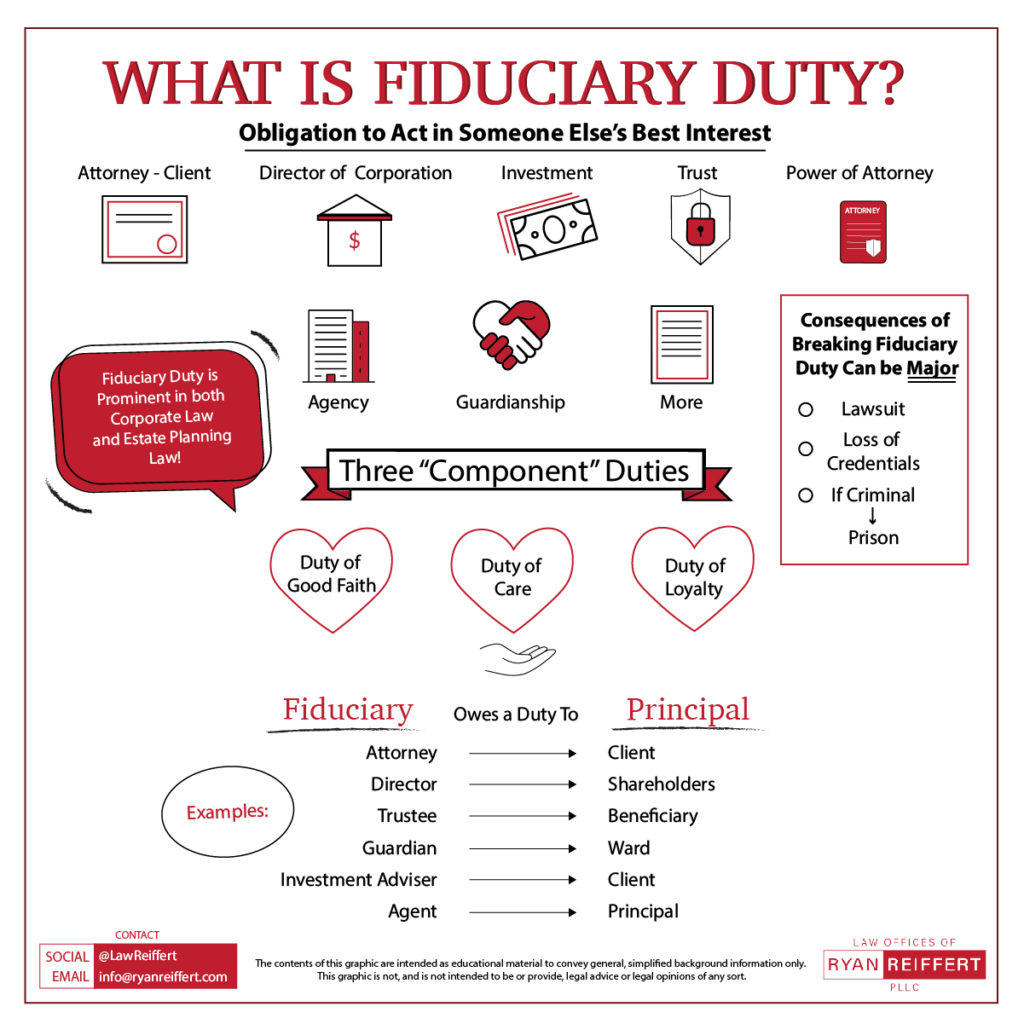

One of the areas in which corporate law and estate planning law have some amount of overlap is in the concept of fiduciary duties. An executor of an estate and a trustee of a trust, for example, each has a fiduciary duty to the beneficiaries. Similarly, a corporate director has a fiduciary duty to the shareholders.

… but what does it actually mean to say that someone is subject to a fiduciary duty? Read on to learn more about what a fiduciary duty is and how it might impact you.

What is Fiduciary Duty?

Do you owe a fiduciary duty to anyone? Chances are that you do, but may not fully understand your legal obligations or inherent risks in that capacity. What are fiduciary duties and what are the risks if you don’t fulfill them as a business owner? Fiduciary Duty, Defined

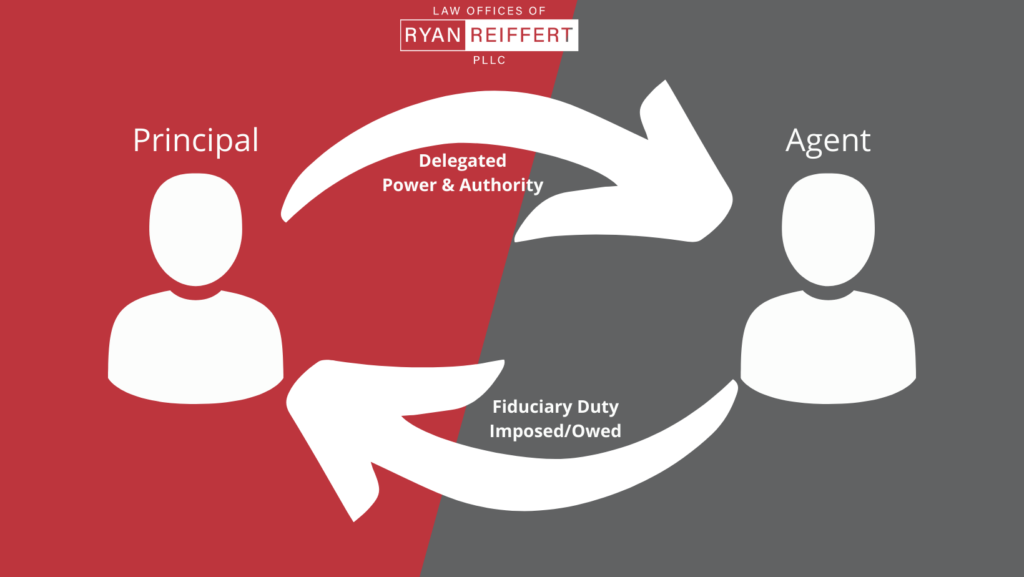

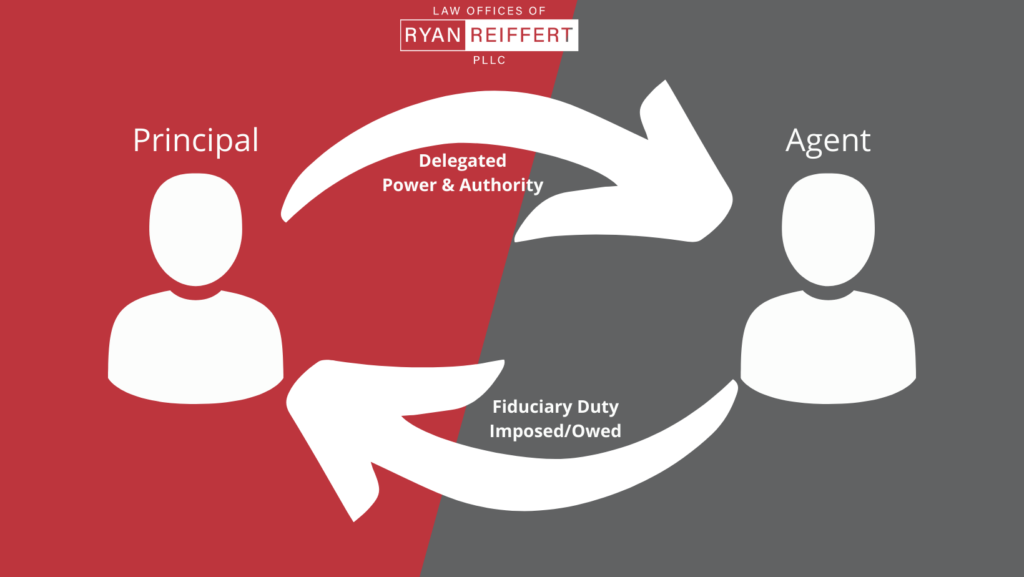

When you have a fiduciary duty toward another, you are legally responsible for acting in a trustworthy capacity within the relationship. This includes acting with professionalism and discretion, accepting the trust and confidence that the other person has placed in you. As a fiduciary, you owe the other party, or beneficiary, the highest degree of care and devotion. While there are many different duties that the law recognizes, none is held to as high an obligation as a fiduciary duty.

Legally, a fiduciary duty obligates you to certain things. First, you have a legal duty to act in the other party’s best interests over your own. This also requires that you have no conflicts of interest that may cloud your duty to the other party. If you act in any way that is not in accordance with your fiduciary duty, you can be held in breach and potentially legally accountable for any consequences.

Did You Agree to This Duty?

Depending on the situation and your role in the relationship, a fiduciary duty may be inherent to that role. In other words, you are obligated to it without expressly agreeing to it. I’m going to say that again to be sure that you got it – a person can “accidentally” become a fiduciary without expressly agreeing to it! For instance, attorneys, company executives, financial advisors, and trustees all have fiduciary duties toward their clients, stockholders, investors, and other beneficiaries. An employee has a fiduciary duty toward their employer. A marriage partner, a parent, a therapist, a doctor — whenever one person is acting in a place of trust and confidence in another, there is a fiduciary duty involved.

Some common fiduciary roles and their beneficiaries can include both business roles and nonbusiness roles

Fiduciary Duty, Defined

When you have a fiduciary duty toward another, you are legally responsible for acting in a trustworthy capacity within the relationship. This includes acting with professionalism and discretion, accepting the trust and confidence that the other person has placed in you. As a fiduciary, you owe the other party, or beneficiary, the highest degree of care and devotion. While there are many different duties that the law recognizes, none is held to as high an obligation as a fiduciary duty.

Legally, a fiduciary duty obligates you to certain things. First, you have a legal duty to act in the other party’s best interests over your own. This also requires that you have no conflicts of interest that may cloud your duty to the other party. If you act in any way that is not in accordance with your fiduciary duty, you can be held in breach and potentially legally accountable for any consequences.

Did You Agree to This Duty?

Depending on the situation and your role in the relationship, a fiduciary duty may be inherent to that role. In other words, you are obligated to it without expressly agreeing to it. I’m going to say that again to be sure that you got it – a person can “accidentally” become a fiduciary without expressly agreeing to it! For instance, attorneys, company executives, financial advisors, and trustees all have fiduciary duties toward their clients, stockholders, investors, and other beneficiaries. An employee has a fiduciary duty toward their employer. A marriage partner, a parent, a therapist, a doctor — whenever one person is acting in a place of trust and confidence in another, there is a fiduciary duty involved.

Some common fiduciary roles and their beneficiaries can include both business roles and nonbusiness roles

How Can This Affect You?

In the business world, it’s important to understand the nature of your particular fiduciary duties and how they may expose you to liability if you fail to act within your legal responsibilities.

For instance, if an attorney takes on a client, there is a fiduciary duty inherent in that relationship that says that the attorney will act in the best interests of the client and use professionalism and discretion when protecting that client’s interests. If the attorney realizes that is a potential conflict of interest between the new client and another or former client, he or she must immediately disclose that to both parties. They have the option to waive those conflicts. If that doesn’t happen, the attorney has the responsibility to remove himself or herself from representing the new client. This is required despite any personal cost to the attorney and is why attorneys in some jurisdictions will do a conflict search to ensure this doesn’t happen.

Fiduciary Duty and Personal Liability

Fiduciary duty imposes personal liability on a person who has breached their duty. When a breach involves a lawsuit, the party in breach may be faced with serious consequences, including monetary penalties, damages, and legal fees. While there are insurance policies that will cover a beneficiary against a possible negligent breach, in most cases, the law will still impose liability on that person. If it is found that the breach was willful, insurance will usually not cover the liability.

When a beneficiary claims a fiduciary breach, there are certain elements that must be proven in a successful claim.

How Can This Affect You?

In the business world, it’s important to understand the nature of your particular fiduciary duties and how they may expose you to liability if you fail to act within your legal responsibilities.

For instance, if an attorney takes on a client, there is a fiduciary duty inherent in that relationship that says that the attorney will act in the best interests of the client and use professionalism and discretion when protecting that client’s interests. If the attorney realizes that is a potential conflict of interest between the new client and another or former client, he or she must immediately disclose that to both parties. They have the option to waive those conflicts. If that doesn’t happen, the attorney has the responsibility to remove himself or herself from representing the new client. This is required despite any personal cost to the attorney and is why attorneys in some jurisdictions will do a conflict search to ensure this doesn’t happen.

Fiduciary Duty and Personal Liability

Fiduciary duty imposes personal liability on a person who has breached their duty. When a breach involves a lawsuit, the party in breach may be faced with serious consequences, including monetary penalties, damages, and legal fees. While there are insurance policies that will cover a beneficiary against a possible negligent breach, in most cases, the law will still impose liability on that person. If it is found that the breach was willful, insurance will usually not cover the liability.

When a beneficiary claims a fiduciary breach, there are certain elements that must be proven in a successful claim.

Fiduciary Duty, Defined

When you have a fiduciary duty toward another, you are legally responsible for acting in a trustworthy capacity within the relationship. This includes acting with professionalism and discretion, accepting the trust and confidence that the other person has placed in you. As a fiduciary, you owe the other party, or beneficiary, the highest degree of care and devotion. While there are many different duties that the law recognizes, none is held to as high an obligation as a fiduciary duty.

Legally, a fiduciary duty obligates you to certain things. First, you have a legal duty to act in the other party’s best interests over your own. This also requires that you have no conflicts of interest that may cloud your duty to the other party. If you act in any way that is not in accordance with your fiduciary duty, you can be held in breach and potentially legally accountable for any consequences.

Did You Agree to This Duty?

Depending on the situation and your role in the relationship, a fiduciary duty may be inherent to that role. In other words, you are obligated to it without expressly agreeing to it. I’m going to say that again to be sure that you got it – a person can “accidentally” become a fiduciary without expressly agreeing to it! For instance, attorneys, company executives, financial advisors, and trustees all have fiduciary duties toward their clients, stockholders, investors, and other beneficiaries. An employee has a fiduciary duty toward their employer. A marriage partner, a parent, a therapist, a doctor — whenever one person is acting in a place of trust and confidence in another, there is a fiduciary duty involved.

Some common fiduciary roles and their beneficiaries can include both business roles and nonbusiness roles

Fiduciary Duty, Defined

When you have a fiduciary duty toward another, you are legally responsible for acting in a trustworthy capacity within the relationship. This includes acting with professionalism and discretion, accepting the trust and confidence that the other person has placed in you. As a fiduciary, you owe the other party, or beneficiary, the highest degree of care and devotion. While there are many different duties that the law recognizes, none is held to as high an obligation as a fiduciary duty.

Legally, a fiduciary duty obligates you to certain things. First, you have a legal duty to act in the other party’s best interests over your own. This also requires that you have no conflicts of interest that may cloud your duty to the other party. If you act in any way that is not in accordance with your fiduciary duty, you can be held in breach and potentially legally accountable for any consequences.

Did You Agree to This Duty?

Depending on the situation and your role in the relationship, a fiduciary duty may be inherent to that role. In other words, you are obligated to it without expressly agreeing to it. I’m going to say that again to be sure that you got it – a person can “accidentally” become a fiduciary without expressly agreeing to it! For instance, attorneys, company executives, financial advisors, and trustees all have fiduciary duties toward their clients, stockholders, investors, and other beneficiaries. An employee has a fiduciary duty toward their employer. A marriage partner, a parent, a therapist, a doctor — whenever one person is acting in a place of trust and confidence in another, there is a fiduciary duty involved.

Some common fiduciary roles and their beneficiaries can include both business roles and nonbusiness roles

- Lawyer/client

- Doctor/patient

- Executor of a will/beneficiaries

- Trustee/beneficiaries

- Real estate broker/purchasers

- Stockbroker/investors

- Agent/principal

- Corporate director/corporation and shareholders

- Company officer/owners of the corporation

- Partner/other partners

How Can This Affect You?

In the business world, it’s important to understand the nature of your particular fiduciary duties and how they may expose you to liability if you fail to act within your legal responsibilities.

For instance, if an attorney takes on a client, there is a fiduciary duty inherent in that relationship that says that the attorney will act in the best interests of the client and use professionalism and discretion when protecting that client’s interests. If the attorney realizes that is a potential conflict of interest between the new client and another or former client, he or she must immediately disclose that to both parties. They have the option to waive those conflicts. If that doesn’t happen, the attorney has the responsibility to remove himself or herself from representing the new client. This is required despite any personal cost to the attorney and is why attorneys in some jurisdictions will do a conflict search to ensure this doesn’t happen.

Fiduciary Duty and Personal Liability

Fiduciary duty imposes personal liability on a person who has breached their duty. When a breach involves a lawsuit, the party in breach may be faced with serious consequences, including monetary penalties, damages, and legal fees. While there are insurance policies that will cover a beneficiary against a possible negligent breach, in most cases, the law will still impose liability on that person. If it is found that the breach was willful, insurance will usually not cover the liability.

When a beneficiary claims a fiduciary breach, there are certain elements that must be proven in a successful claim.

How Can This Affect You?

In the business world, it’s important to understand the nature of your particular fiduciary duties and how they may expose you to liability if you fail to act within your legal responsibilities.

For instance, if an attorney takes on a client, there is a fiduciary duty inherent in that relationship that says that the attorney will act in the best interests of the client and use professionalism and discretion when protecting that client’s interests. If the attorney realizes that is a potential conflict of interest between the new client and another or former client, he or she must immediately disclose that to both parties. They have the option to waive those conflicts. If that doesn’t happen, the attorney has the responsibility to remove himself or herself from representing the new client. This is required despite any personal cost to the attorney and is why attorneys in some jurisdictions will do a conflict search to ensure this doesn’t happen.

Fiduciary Duty and Personal Liability

Fiduciary duty imposes personal liability on a person who has breached their duty. When a breach involves a lawsuit, the party in breach may be faced with serious consequences, including monetary penalties, damages, and legal fees. While there are insurance policies that will cover a beneficiary against a possible negligent breach, in most cases, the law will still impose liability on that person. If it is found that the breach was willful, insurance will usually not cover the liability.

When a beneficiary claims a fiduciary breach, there are certain elements that must be proven in a successful claim.

- First, it must be proven that a fiduciary relationship existed. While many professional associations have that inherent to the relationship, a fiduciary duty is best proven when there has been a written agreement to that effect.

- Second, the fiduciary behaved in a way that was inconsistent with his or her legal duty and this created a breach of their fiduciary duty.

- The breach must have resulted in financial damages of some kind to the beneficiary.

- Finally, causation must be proven linking the breach of fiduciary duties to the harm to the beneficiary.